Deep xVA - speeding-up derivative pricing

This project took place in summer term 2022, you CAN NOT apply to this project anymore!

Results of this project are explained in detail in the final report.

- Sponsored by: KPMG

- Project Lead: Dr. Ricardo Acevedo Cabra

- Scientific Lead: Johannes Piller, Christina Schairer, Fabian Slezak, Dr. Christoph Anders

- TUM Co-Mentor: Yannick Limmer

- Term: Summer semester 2022

About KPMG

Our teams include around 12,500 people working at 26 locations in Germany. We stand for diversity and a culture of mutual respect and appreciation. This means our teams have varied and complex skills, allowing us to perform interdisciplinary work on innovative matters and also manage large projects. We are looking for talented individuals who want to work with us to tackle the challenges of tomorrow.

In our subcluster ‘Risk & Treasury’ in Financial Services we advise our clients – esp. banks, insurance companies and corporates – on the measurement and management of all risk types (credit risk, market risk, operational risk, liquidity risk, etc.) and on treasury matters. While the main focus is still essentially on approved traditional methodologies and machine learning (ML) approaches, we are helping our clients with the identification and development of more advanced ML- or AI-based use cases with a positive business case and regulatory conformity. This includes e.g. proof of concept, prototyping and succeeding implementation of such ML and AI methods with the aim of increasing efficiency and economical benefit in the client’s organization.

About the project

Would you like to make a meaningful contribution bringing Deep Learning into Derivative Pricing?

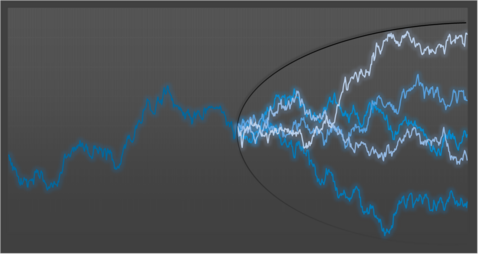

Problem: The value of a derivative corresponds to the discounted expectation of its payoff which is usually calculated under the risk-neutral measure. However, the risk-neutral value does not account for various risks and costs that are associated with derivative trading, e.g. the risk of default (counterparty credit risk), funding costs, or the cost of capital. To capture these risk factors and costs in the pricing process financial institutions compute valuation adjustments, (e.g. Credit Valuation Adjustment (CVA), Funding Valuation Adjustment (FVA), or Capital Valuation Adjustment (KVA)). As the calculation of these so called “xVAs” requires a large number of simulations and is therefore extremely computationally intensive and time-consuming, they are not usable in intraday processes (e.g. pricing, pre-deal checks). Instead, financial institutions rely only on very rough approximations.

With the help of a neural network, the calculation of an (incremental) XVA can be speed up to allow faster and precise (intraday) pricing and hence improve risk measurement to give the bank a competitive advantage. This approach if solved well has the potential to revolutionize derivative pricing!

Objective: First, you will simulate a portfolio of interest rate and foreign exchange products with the help of our subject matter experts. Then, guided by our Machine Learning team you will develop a deep learning approach to approximate current CVA, FVA and KVA valuation functions based on the simulated portfolio with the aim to speed up xVA calculation while maintaining a reasonable valuation accuracy.

Accepted students to this project should attend (unless they have proven knowledge) online workshops at the LRZ from 19.04. - 22.04.22. More information will be provided to students accepted to this project.